If you were worrying you might run out of traditional-publisher vitriol since it’s been a week since Hugh Howey uncorked a gusher of it with his original post on Amazon web crawl analytics, fear not! Not content to analyze 7,000 genre titles, Howey and his Stats Guy went back and crawled the top 50,000 books on Amazon across all genres and categories for a single day (Febuary 7th) and ran some analyses on that data set (and, naturally, offered up all the raw data for other statisticians to crunch however they like).

If you were worrying you might run out of traditional-publisher vitriol since it’s been a week since Hugh Howey uncorked a gusher of it with his original post on Amazon web crawl analytics, fear not! Not content to analyze 7,000 genre titles, Howey and his Stats Guy went back and crawled the top 50,000 books on Amazon across all genres and categories for a single day (Febuary 7th) and ran some analyses on that data set (and, naturally, offered up all the raw data for other statisticians to crunch however they like).

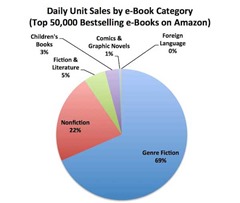

This time he’s got stats not only for genre fiction, but for non-fiction, literary fiction, and childrens’ books as well. Perhaps unsurprisingly, the category where independent publishing most rules the roost is genre fiction, but his crunching shows it’s made respectable inroads into the other categories as well. By and large, his conclusions are the same as in the previous set.

However, the most interesting analysis comes when he removes the top 1,000 titles and crunches the data for the other 49,000—since, after all, if the chart was being skewed by a few excessively popular outliers, removing the most popular titles should show a different picture. But not only does the chart look similar, the percentage of Big Five published books drops from 39% to 32%. The proportion of Amazon-published books also drops, while indie-published, small- or medium-publisher, and uncategorized single-author publisher each gain some points.

This would seem to suggest that, whereas Big Five publishing is more reliant on bestsellers, indie publishing draws its numbers from lots of smaller sales. The pieces of pie each indie book gets might be smaller, on average—but on the other hand, in terms of revenue, they don’t have a traditional publisher going around with a fork and taking away everything but the crust.

Anyway, if you enjoyed reading all the reactions to the last set, you might want to lay in a supply of popcorn because I’m sure all the usual players will have all the same things to say—all the more vociferously, since the data again supports the same conclusions. And traditional publishers need to be able to attract bestsellers in order to stay profitable, so they and their partisans are heavily invested in getting writers not to buy into self-publishing.

So, if you were saddened that the well of traditional publisher vitriol for Howey’s statistics was starting to run dry, never fear. He’s tapped another gusher of it.

Perhaps the most interesting stats may be yet to come—at the end, he teases the results of a similar crawl of Barnes & Noble that “surprised” them. We’ll have to see how that goes.

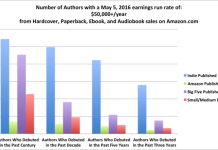

This makes perfect sense to me. The historical trends in publishing since the 1980s have been consolidation in both retail outlets and among publishers, with a focus on the occasional blockbuster that pays the large overheads and largely drives title acquisition behaviors. Because of this trend, indie publishers have been growing but with decreasing retail access, until along come ebooks making this once again viable at both the micro-publisher level (my firm Publerati only publishes literary fiction as ebooks, a declining category that surely needs help from innovation) and also at the individual author level via self-publishing. A healthy industry is always one with many new young shoots; a declining one is always retrenching via consolidation. This data seems to support this ongoing reality and, as a reader, is one I personally view as a logical historical outcome brought about by the narrowing options among traditional outlets in recent decades.