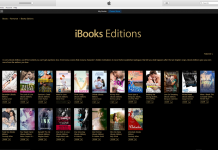

Remember how Apple’s e-book prices were going to be several dollars more expensive than Amazon’s? Alexander Vaughn at AppAdvice has gotten a sneak preview of the iBooks store, including a screenshot that depicts pricing on some of the books. Vaughn notes:

Remember how Apple’s e-book prices were going to be several dollars more expensive than Amazon’s? Alexander Vaughn at AppAdvice has gotten a sneak preview of the iBooks store, including a screenshot that depicts pricing on some of the books. Vaughn notes:

Anyway, at the moment, out of the 32 eBooks featured in the New York Time’s Bestsellers section, 27, including the entire top 10 are priced at $9.99.

And of the five that are higher, even the highest of them is $12.99—about $4 more than the Kindle version.

Of course, this isn’t entirely a surprise, given what the New York Times’s anonymous sources said last month about the pricing negotiations. But this marks the first concrete proof that Apple is going head-to-head with Amazon on best-sellers.

And given that Amazon’s pricing contract requires that it not be undersold, presumably Amazon will continue to get to charge the same amount for bestsellers even under the Big Five’s agency pricing model.

So, it appears that all the publishers have really accomplished with Apple’s pricing model is to reduce the amount of money they’ll be getting for each $9.99 bestseller from the half-of-retail wholesale cost down to 70% of $9.99. But at least they’re in control of pricing now.

As the old joke goes, they’ll be losing money on every sale now—but maybe they can make it up in volume?

Well, it could be that Apple suckered the publishers into giving them a 30% price cut, but it is just as likely that we’re looking at loss-leader pricing. Let’s say iBooks launches at the Amazon “legacy” price for a few months or a year until they build up a locked-in customer base (Apple’s own DRM, remembber?) and then they slowly increase the number of $12.99 bestsellers until they reach a point when they think nobody notices/cares and the $9.99 “legacy” prices is gone.

Wherever their long-term price-fixing plans may lead, the BPHs are stuck with a starting point of $9.99; their choices are either to implement it cold turkey and risk an effective boycott, or to bite the bullet and finesse it by gradually raising prices until the customers don’t notice.

In effect, they’re subsidizing Apple’s ramp up costs.

All that remains to be seen is what that ramp up buys them; an effective counter to Amazon, a new more tyranical overlord (ask the music studios), or an apple pie in the face.

Nothing is written in stone.

Makes a lot of sense as nearly all print booksellers deeply discount the NYT best seller list leading to the potential absurdity of higher priced (or almost higher priced) ebooks for those volumes. It was a widespread practice long before Kindle came along to price those top best sellers at a deep discount as a loss leader.

But depth will be key. Is Apple matching $9.99 on 20 top sellers, 100, 1,000? I think one thing that continues to hold some of the other players back is the relatively smaller proportion of deeply discounted ebooks.

Wait, so the sequence of events were:

1) Amazon discounting many/most bestsellers to $9.99 (others a few dollars more), often losing money. Publishers making the same as from bookstores selling at $26, but fear Amazon will eventually force them to drop the list price to the low levels. Claimed they’d lose money themselves if that happened.

2) Apple, Macmillan, and others enter into an agency model deal where the publishers get to set the retail price. “Nya nya, Amazon. You has been thwarted!” Big kerfuffle between Amazon and Macmillan.

3) Apple forces the publishers to drop the list price, agency style now, to the nefarious Amazon levels: $9.99 for many/most bestsellers, some a few dollars more. Amazon likely to get the same deal.

4) Publishers end up with what they said they feared. (But are claiming victory?)

Interesting times.

@Aaron Pressman: Right you are.

The issue isn’t whether *some* high-visibility books are the same or even cheaper. Its whether the average price of the *entire catalog* is competitive.

That would explain Amazon’s insistence on retaining price flexibility on non-BPH books, no?

After all, when B&N launched their ebook store last fall, they prclaimed they had “hundreds of bestsellers as low as $9.99”.

Amazon had thousands.

(And tens of thousands well under $9.99)

And it quickly came out that, google crapscans aside, the Amazon storefront was averaging 15-20% lower average pricing.

It’s that old pesky basket pricing matter all over again: as long as a significant share of the Amazon catalog remains outside the price-fixing scheme, the Amazon storefront will retain its advantage of lower average prices. And unless a particular buyer only reads price-fixed ebooks, Amazon will remain the storefront of choice.

Lots of squirming, little progress.

Until the Apple bookstore actually opens and the first books are sold, pricing — sneak peeks included — are just speculation.

It’s very simple, and very clearly spelled out in the various articles written over the past weeks about the contracts Apple is signing with publishers: all best sellers go for $9.99.

There’s really nothing new here.

I wouldn’t be surprised to have seen that info about the Apple contracts on Teleread in weeks past.

Amazon’s contracts, of course, stipulate that they get the same deals as any other e-retailer, so it will be the case that the top-10 best sellers will be ebooks for $9.99.

Apple, of course, doesn’t much care what prices the books are; they want to sell the devices. Revenues from the iBookstore, like those from iTunes store and App store, are side-change to them.

— asotir

The publishers knew very well that they would make less money with the agency model. They said so straight up.

What the agency model (or indeed any model other than the model Amazon was trying to dictate) is that it does not lock the publisher into being at the complete, utter and total mercy of Amazon.

Short-term loss to retain a modicum of flexibility.

Given the choice of the mercy of Jeff Bezos and the mercy of Steve Jobs, I MIGHT choose Bezos. OTOH, neither will be mistaken for the Virgin Mary any time soon. It stinks to be a publisher.

Regards,

Jack Tingle

OR NOT – http://appadvice.com/appnn/2010/03/exclusive-ipad-ibooks-prices-shoot/